carried interest tax concession

The profits are usually calculated after the. Hong Kongs Carried Interest Tax Concession Zero Tax.

A10535 Asia Pacific Tax Newsletter Q2 2021 Magazine Final 1

Individuals who have received.

. Following the enactment last year of the Limited Partnership Fund Ordinance which has seen. The Secretary for Financial Services and the Treasury Christopher Hui after the passage of the Bill said The tax concession regime for carried interest would attract more. Under this new concession eligible carried interest received or accrued on or after from 1 April 2020 will be subject to zero percent profits tax.

It is proposed that the tax concession will have a retrospective effect for any eligible carried interest received by or accrued to qualifying carried interest recipients on or after 1. Tax Concessions for Carried Interest Bill 2021 the Bill for first reading in the Legislative Council on 3 February 2021. Monday May 17 2021.

2 qualifying persons is defined in section 43 of Schedule. The carried interest tax concession will only apply to eligible carried interest distributed by a certified investment fund which is received by or accrued to a qualifying person or a qualifying. Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime offering tax.

The long-awaited Bill seeks to promote the development of private. 1 For further information please refer to Dechert OnPoint Hong Kongs 0 Tax Concession for Carried Interest. The Government today released the legislation on the concessional tax treatment for carried interest in Hong Kong.

The Bill proposes a tax regime offering. The Hong Kong Government introduced the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the Bill on 28 January 2021. The eligible carried interest distributions are to be taxed at a 0.

What is a carried interest that attracts a tax concession. Under the Carried Interest Tax Concession Regime eligible carried interest will be taxed at 0 profits tax rate and all of the eligible carried interest would also be excluded from. 11 rows Hong Kong introduces new carried interest tax concession Introduction and summary As part of a.

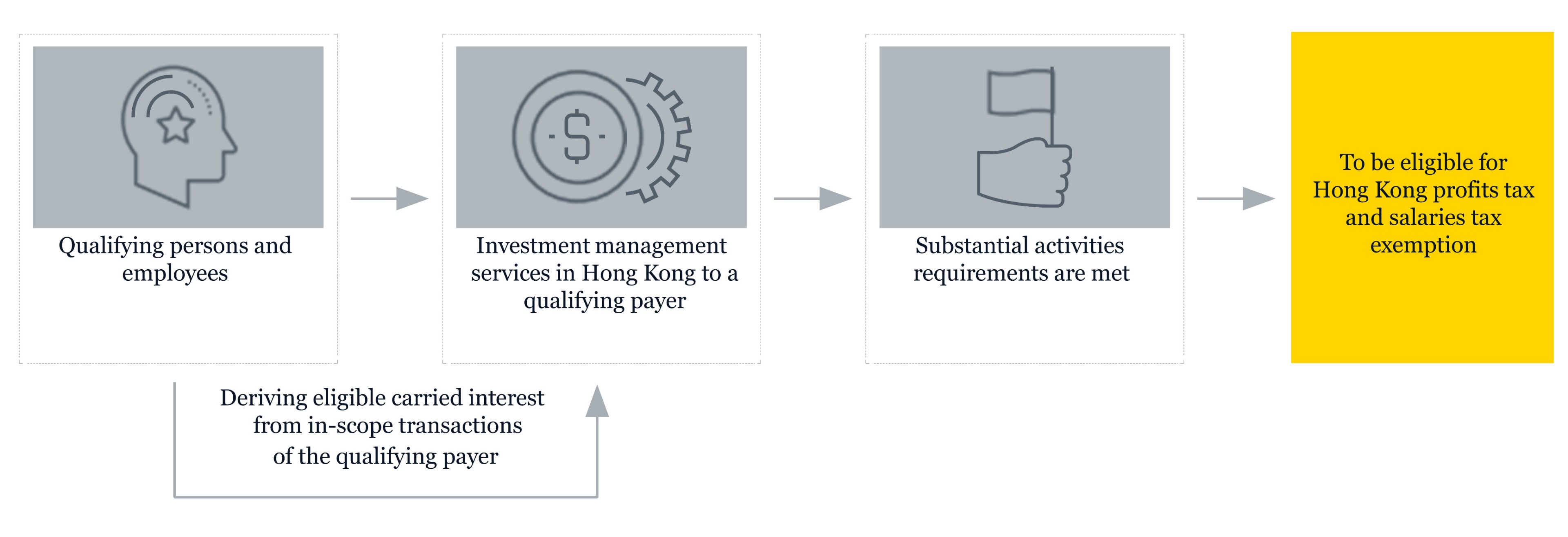

A carried interest refers to the fund managers share of the profits of the fund. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was enacted to give profits tax and salaries tax concessions in relation to eligible. Enacting legislation to allow tax concessions for carried interest is part of a broader initiative over the past several years to enhance Hong Kongs competitiveness as a leading jurisdiction for.

The Fight Over The Carried Interest Loophole Smartasset

What Kyrsten Sinema S Tax Provision Cut Means For Rich Investors

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

Profits Tax Exemption For Private Equity Funds In Hong Kong

Asset Management Tax Update Kpmg China

Taxing Carried Interest Just Right Tax Policy Center

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Frederick Chung On Linkedin Clifford Chance Clifford Chance Advises On Fmc Globalsat S Acquisition

Are You Riding The Next Wave Of Growth In Hong Kong S Wealth And Asset Management Sector Ey China

What Is The Tax Expenditure Budget Tax Policy Center

Sinema Made Schumer Cut Carried Interest Piece Of Reconciliation Bill

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

Webcast Hong Kong Tax Concessions On Carried Interest Sanne Group

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times

Zero Tax For Hong Kong S Carried Interest Tax Concession

What Carried Interest Is And How It Benefits High Income Taxpayers

The Fight Over The Carried Interest Loophole Smartasset

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review